Home Equity is rising, interest rates are low, Mortgage Applications are declining and ReFi’s are rising – Read the leading indicators to take advantage of a Window of Opportunity in the market. There is no bust on the horizon and appreciation is leveling off, what are you waiting for as your affordability budget diminishes? Stop listening to the hype around Forbearance, it represents 1.8% of all mortgages across the United States – 1.8M homes out of 100.8 homes! Forbearance sound bytes are hype news.

Homeownership remains a staple in building wealth through real estate and realizing the American dream. Owning a home has longer term stability benefits in ‘fixing’ the largest cost item is most folks monthly budget as the living expense.

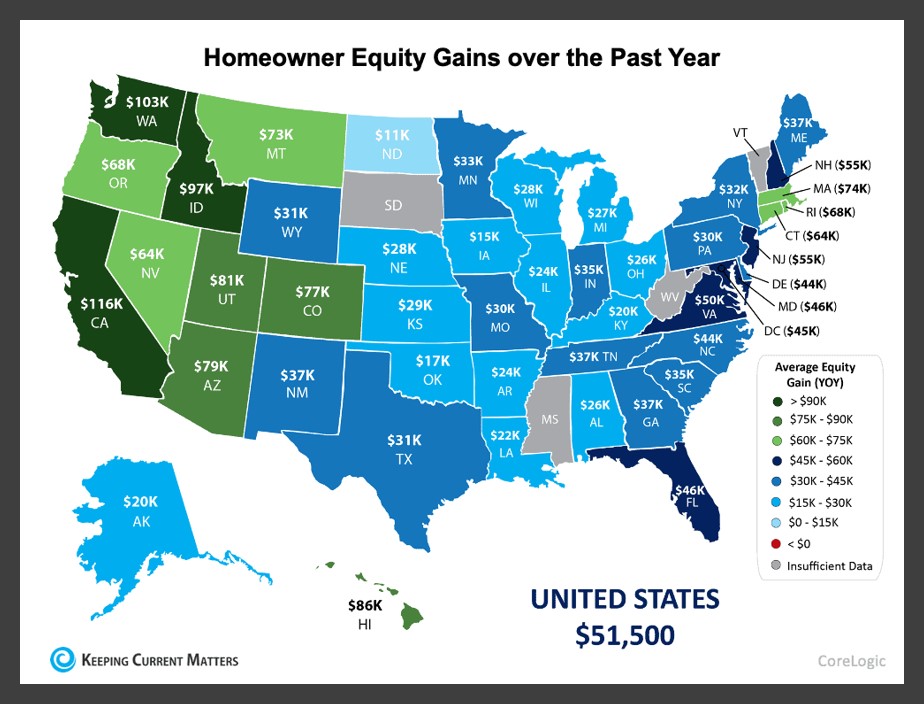

In the most recent data from the CoreLogic: Homeowner Equity Insights Report, home equity has continued to grow as home values appreciated (in double digits for the Northern Virginia area). Equity is the difference between what is owed on the property and the current market value of the property. This is extremely beneficial to those who chose forbearance in 2020, allowing them to reset their loans and avoid foreclosure. The interest rates were low, driving both buyer demand and homeowner refinancing in 2020 creating an out of balance situation benefiting the homeowners and thus sellers creating stiff buyer competition.

The below chart illustrates:

- Average homeowner gained $51,000 in equity over the past year

- Equity gain is a 29.3% increase in national homeowner equity year over year

The below chart gives you an idea of what this looks like for Virginia in relation to the rest of the country.

Virginia is middle of the road with the west and northeast leading in home equity gains. I know I’m seeing far less Open House traffic and hearing potential buyers say that they are waiting. Waiting for what? The prices to drop? Interest rates to rise? What?

Today, interest rates remain low and yet Mortgage Applications are dropping, while ReFi’s are rising. ReFi’s should be on the rise due to the ability to reset your mortgage and exit forbearance. Of the 139M homes in the United States, 72%, or 100M, carry a mortgage and thus the 1.8M that took forbearance in 2020 represent only 1.8% of homes in the United States.

Many took it for investment purposes and others needed the relief. Now with the increased equity in their homes and the decreased interest rates, they are able to reset their loans without going into foreclosure. So for those of you thinking there is a bust coming in the market, you might be in for a surprise waiting on that deal based upon a perceived foreclosure event. There are deals in this market if you are willing to look at the homes in need of some repair and polish with the diminished competition. Hint Hint Hint!

Now the researcher in me is kicking in and looking at the trends for the predictive analytics of the market. I still haven’t gained a psychic super power but there are two previous predictive trends you might consider as you postpone your selling or buying decisions. This is the SO WHAT in this analysis.

I placed the Mortgage News Daily Refinance Index on top of the Purchase Index to take a look at Supply versus Demand and the relationship to the interest rates and something very interested jumped off the page.

SUPPLY AND DEMAND

In February 2020 interest rates fall and Mortgage Applications Skyrocket creating demand in a market with ReFi’s at an ~15 year high. The ReFi Index is the supply, homeowners saying they are not selling and are reinvesting in their homes and property. In March 2020 the interest rates started to rise and the ReFi Index skyrockets, while Mortgage Applications plummets. This was a Window of Opportunity for buyers to take advantage of less competition in the market.

Interest rates slowly decline and ReFi’s level off, while continuing at about a 15 year high. This is your supply index. Those who are Refinancing are in all likelihood NOT selling and are reinvesting in their current property and home driving supply down under 1 month and into a week at times of inventory in the Northern Virginia area.

As the interest rates continue to decline, Mortgage Applications begin rising again, also at 15 year highs. Now once again in the March’ish 2021 interest rates start to rise and ReFi’s skyrocket with Mortgage Applications plummet. Again, this is a Window of Opportunity for buyers prior to the spring market with declining competition.

Now for the third time, ReFi’s are on the rise as Mortgage Applications decline. Success leaves Clues, the Window of Opportunity. Some of this is the 1% of Forbearance ReFi’s but a very very small portion

CONCLUSION AND ADVICE

Buyers, watch the interest rates like a homeowner. Follow it to the bottom and the second it ticks up, follow the homeowners who ReFi, instead of the rest of the buyers who get spooked and exit the market. Inventory is low and will remain low due the 15 year high in ReFi’s but you can beat the competition and enter the market when they flee the market. I’m pretty sure I watched a news interview with Warren Buffett where he made a statement about buying when the rest of the market is fleeting.

We have two trends of leading indicators over the past year indicating that buyers looking for a Window of Opportunity, follow the lead of the ReFi folks, the sellers! It doesn’t mean that the market cratered, it merely means you have less competition and more room to negotiate! If you want a bargain, look at those properties that have been on the market for a while and learn to apply sweat equity (or hire a professional) and win with less competition and less desirability!

Sellers, watch the ReFi index and when it levels off and buyers are back in the market, it’s time to sell. Appreciation is stabilizing and getting back in line with a more traditional 4-6% annually. When the Mortgage Application index skyrockets due to low interest rates, competition is high – just be prepared and have your home in competitive condition!

Be sure to check out the Home Valuation Tool or reach out for your personalized Home Value Report!

I look forward to supporting you soon!