As a realtor in Northern Virginia, it’s my duty to guide you through the complexities of the housing market and help you make informed decisions. One of the most significant considerations for potential homebuyers is interest rates. Currently, they stand at 7%, and while some might be hesitant to commit at this rate, I’m here to tell you why waiting for them to drop to 6% might not be the wisest choice.

Let’s break it down.

The Cost of Waiting

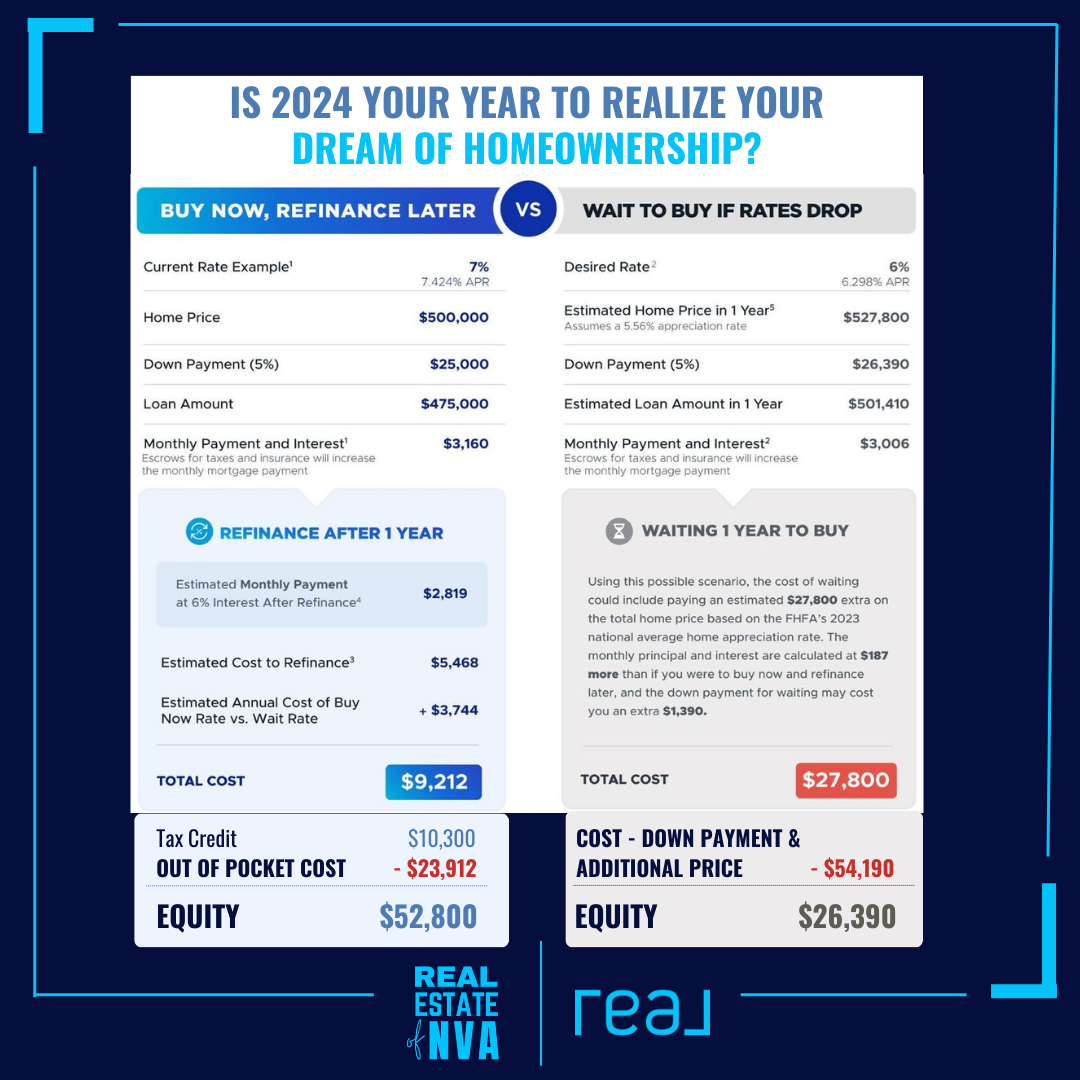

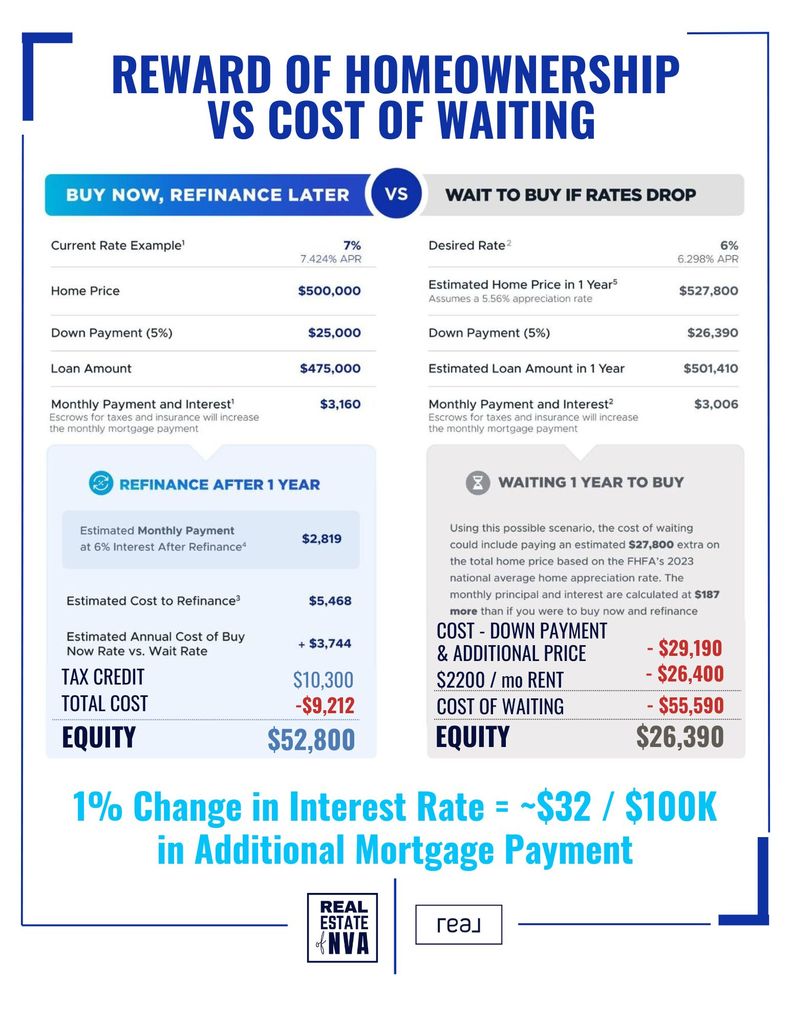

First, let’s address the misconception that waiting for a lower interest rate will save you money in the long run. Yes, a 1% drop in interest rates sounds appealing, but what’s often overlooked are the associated costs and benefits lost while waiting.

For every 1% decrease in interest rates, the cost per $100,000 of your mortgage increases by $32. This might seem insignificant at first glance, but consider this in the context of a $500,000 home. Waiting for a 6% interest rate would cost you $160 per month on your mortgage payment, assuming all else remains constant.

However, waiting and refinancing do come with a set of expenses. Refinancing your mortgage when rates drop to 6% involves additional costs, including refinancing fees and potentially additional down payment funds. In our scenario, the total cost of refinancing amounts to $9,212.

Tax Credits and Future Equity

But what about the tax credit, you may ask? No one is factoring in the tax credit that will be received. In this scenario you could potentially earn a tax credit of approximately $10,030, it’s essential to consider the bigger picture. Waiting means you’ll be paying rent in the meantime, likely amounting to around $24,000+ in this area over the course of the year.

Additionally, by waiting, you’re missing out on the opportunity to build equity in your home. If you purchase now at 7% interest rates, your home’s value is projected to rise to $527,800 in a year, you just earned your rent instead of paying rent! This example illustrates the building of $52,800 in equity. On the other hand, if you wait and purchase at a higher price of $527,800, your equity is essentially nothing after factoring in the additional rental expense.

Total Costs and Equity Comparison

Let’s compare the total costs and equity between buying now and waiting:

**Buying Now**

- Home Cost: $500,000

- Down Payment: $25,000

- Mortgage Payment: $3,160

- Future 1 Year Home Value: $527,800

- Refinance Cost: $5,468

- Additional Mortgage Payment: $1,898 ($154 * 12 factroed into the estimated annual cost)

- Tax Credit: $10,300

- Estimated Annual Cost of Buy Now Rate: $3,744

- Total Cost: $9,212 ($5,468 + $3,744)

- Equity built: $52,800 ($25,000 + $27,800)

- Future Mortgage Payment after Refinance: $2,819

**Waiting**

- Future Home Cost: $527,800

- Down payment (increased): $26,390

- Mortgage Payment: $3,006

- Rent payments: $26,400

- Tax Credit: $0

- Total Cost: $80,590 ($27,800 + $1,390 + $26,400)

- Equity built: $26,390

- Mortgage Payment: $3,006 ($187 higher by waiting)

Educational Takeaway

The numbers speak for themselves. By purchasing now with a 7% interest rate, you stand to gain significantly in terms of equity and long-term financial stability. While waiting for interest rates to drop may seem tempting, the associated costs and missed opportunities outweigh the potential short-term savings.

Furthermore, it’s crucial to recognize the broader economic context. Interest rates are influenced by various factors, including inflation, economic growth, and Federal Reserve policies. While they may fluctuate over time, trying to time the market perfectly is a risky endeavor. Fortutnately in Northern Virginia, we enjoy a healthy, balanced job market with Federal, Military employment and economic growth is booming with the technology industry!

Instead, focus on the fundamentals of homeownership and the long-term benefits it offers. Owning a home provides stability, potential for appreciation, and the opportunity to build wealth over time.

BOTTOM LINE

The right time to buy a home is when it aligns with your financial goals and circumstances, rather than trying to predict interest rate movements. With interest rates currently at 7%, there’s no need to wait for them to drop to 6% to make a sound investment decision. This is on par with the timing of ending a lease and closing on a home. Trying to match them without overlap on a $2,000/month rental is $67. That’s the cheapest hotel I can think of making your move into your dream of homeownership realty.

As your trusted realtor, I’m here to provide guidance and support throughout the homebuying process. Together, we can navigate the market and find the perfect home for you, maximizing your financial benefits and securing your future.

Don’t let the allure of lower interest rates blind you to the bigger picture. Act now, and seize the opportunity to build equity and create a brighter future for yourself and your family.

As always . . .

Be sure to check out the:

- Home Valuation Tool

- Reach out for your personalized Home Value Report

- Calculate your future mortgage

Don’t forget the Home Buying and Selling Guides !

Never miss an issue by subscribing below and I look forward to speaking with you soon about your free Home Preparation and Market Analysis consultation!